A hawkish tone from the Fed leaves investors in a sad state

Key Observations

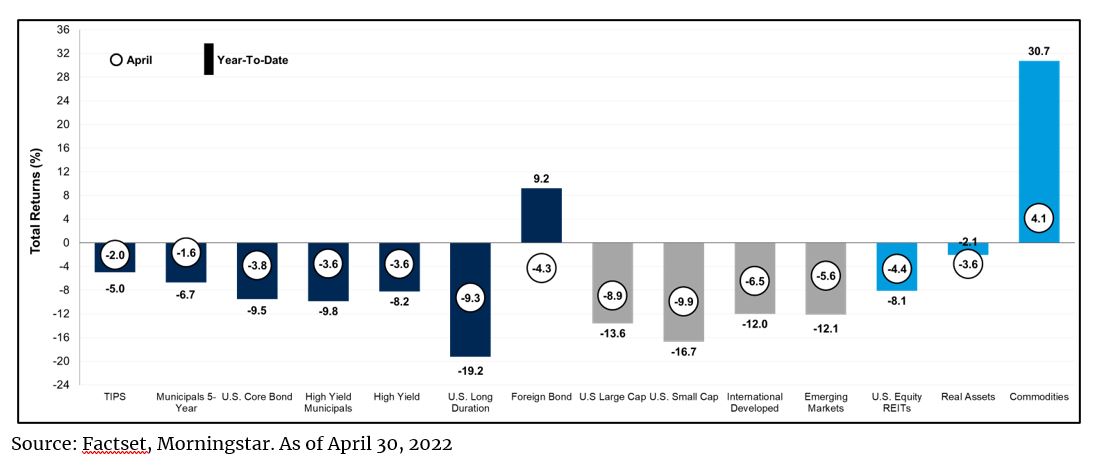

- The quick and material rise in interest rates had significant impacts across asset classes in both April and the year so far.

- Investment grade fixed income is off to the worst four month start since 1976 due to rising rates, inflation concerns, interest rate sensitivity in benchmarks and widening credit spreads.

- While equity markets retreated broadly, geographies and styles most exposed to higher rates lagged more.

- Our outlook for 2022 remains similar to how we entered the year, emphasizing caution toward greater volatility ahead.

Market Recap

“I would say 50 basis points will be on the table for the May meeting,” said Chairman Powell on April 21 during a press conference(1). Pursuing a dual mandate of both full employment and price stability, the Federal Reserve (the Fed) is under pressure to cool off inflation which is near 40-year highs(2). Higher rates have had an adverse impact on many asset prices globally.

In March, the Consumer Price Index (CPI) rose by 8.5 percent(3) year-over-year. Even though 82 percent(4) of the March increase came from energy and food, considered the more volatile parts of inflation, the Fed acknowledged a need to regain control of prices.

Thus far, the Fed’s only direct action has been to increase the Fed Funds rate by 0.25 percent in March. At the time of writing, the futures market was pricing in a 99.1 percent probability of a 0.50 percent move at the May meeting and a total of ten 0.25 percent increases in 2022 ending the year with a Fed Funds rate of 3.0 -3.25 percent(5). If predictions become reality, that would mark the most hawkish move by the Fed since 1994 when then Fed chair Alan Greenspan increased rates by 3 percent over a year(6).

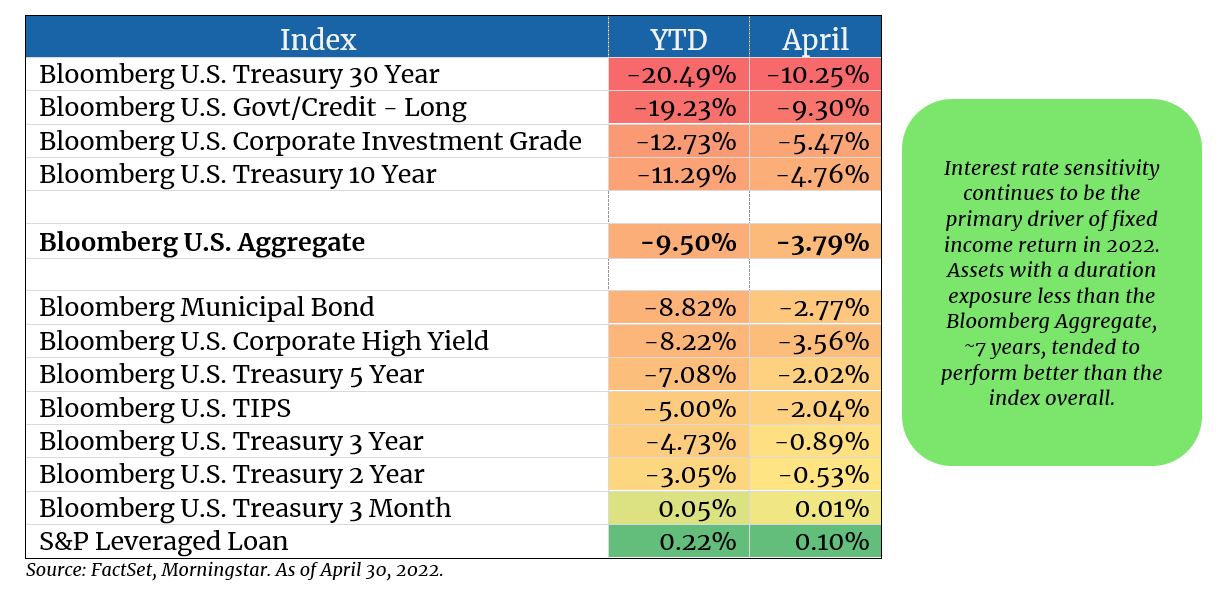

In 1994 the Bloomberg Aggregate was down nearly 2 percent while the Fed raised rates, but it was buoyed by a starting yield-to-worst of 5.62 percent (Fiducient Advisors: Fixed Income Complanency), a benefit we do not enjoy today with significantly lower rates(7). The yield-to-worst on the Bloomberg Aggerate was 1.75 percent at the start of 2022(8).

Although most of the Fed’s action is still ahead of us, the fixed income market has taken them at their word. The Bloomberg Aggregate is off to its worst start since its inception. With few places to hide as demonstrated by the matrix of various fixed income segments shown below, 2022 has been a hard year for bond investors thus far.

While higher rates and lower fixed income prices is a common connection, the connectivity does not stop there. The reverberating effect of higher interest rates has shown its impact throughout the market.

Higher rates showed their sedative powers on highly priced stocks again in April, continuing the trend for 2022. The linkage goes like this:

- Often when valuing a stock an investor will look at the future earnings power of a business.

- To value those future earnings in today’s dollars they will use a discount rate.

- The higher the discount rate, the lower the value of the stock.

So, higher rates lead to more conservative estimates of value. This has had a disproportionate impact on stocks that are heavily reliant on future earnings growth to justify their high valuations. As we can in this table, stocks with higher valuations fell more than their less expensive peers which also impacted growth-oriented indexes more acutely.

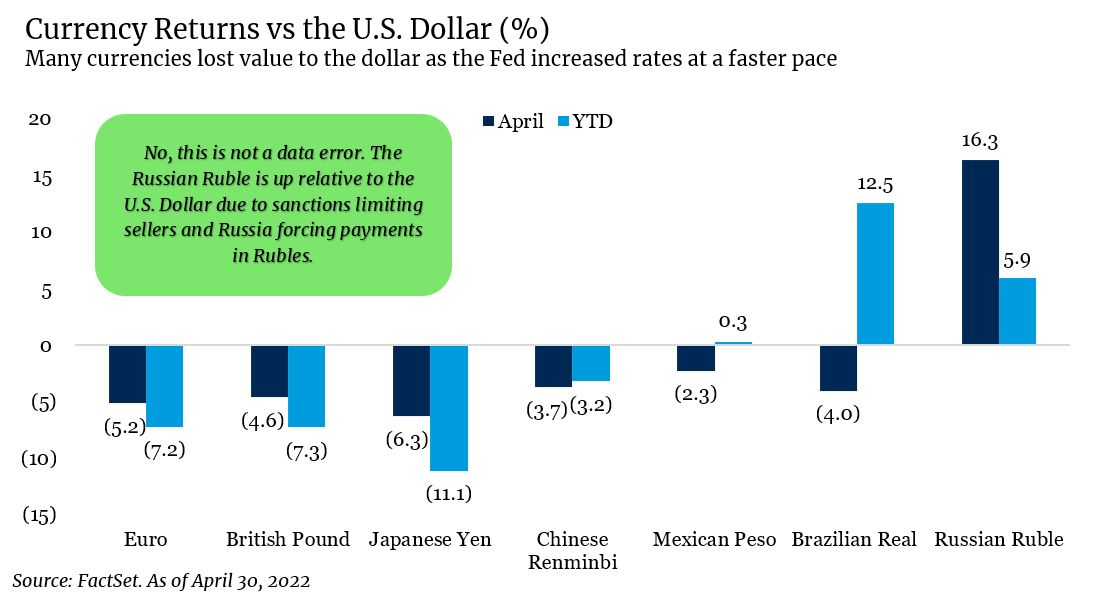

Higher rates do not just stop there. They also impact currency prices and thus far, the Fed has been more hawkish than other central banks, moving U.S. rates higher than those abroad. This in turn makes the U.S. dollar more attractive than other currencies and by extension, assets priced in other currencies are worth less in U.S. dollars if the dollar appreciates.

U.S. dollar strength helps explain some of the U.S. equity outperformance versus international peers, but not all of it. International performance continues to roil around the rise and fall of geopolitical risks. While negative returns were prevalent across broad indexes and sectors, China continued to struggle. Down -3.7 percent in April and -17.63 percent for 2022 the world’s second largest economy and fourth largest market in the ACWI was a primary detractor to Emerging Markets and ex-U.S. stocks in April(9). Lingering concerns from policy reform in 2021, a slowing economy, tensions with the West and disruptions from strict COVID measures have all weighed on investors’ minds. While very few elements of these headlines are new, concerns of their collective impact have accelerated.

Outlook

So where does this leave us? In many ways, with a similar outlook to how we entered the year. In our 2022 Outlook – Navigating Moderation, we discussed the hard road ahead for fixed income and the likelihood of volatility rising as the Fed walks a tightrope for a soft landing, as well as a greater focus on earnings for equities to advance. These factors remain present today and therefore reflect our current positioning in portfolios. We remain keenly focused on these events through our regular process by evaluating risk and opportunities. We continue to stress broad and thoughtful diversification to help maintain a resilient portfolio in what may continue to be a rocky environment.

As always, should you have additional questions, please reach out to any of the professionals at Cedar Cove Wealth Partners.

Footnotes

- Bloomberg

- S. Bureau of Labor Statistics

- S. Bureau of Labor Statistics

- S. Bureau of Labor Statistics

- CME FedWatch Tool

- Fiducient Advisors, Fixed Income Complacency

- Fiducient Advisors, Fixed Income Complacency

- FactSet

- Morningstar

Disclosures and Definitions

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- MSCI ACWI is a stock index designed to track broad global equity-market performance. Maintained by Morgan Stanley Capital International (MSCI), the index is comprised of the stocks of about 3,000 companies from 23 developed countries and 26 emerging markets.

- The Bloomberg U.S. Aggregate index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

- Bloomberg Barclays U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

- Bloomberg U.S. TIPS Index is an unmanaged market index comprised of all U.S. Treasury Inflation-Protected Securities rated investment grade (Baa3 or better), have at least one year to final maturity, and at least $500 million par amount outstanding.

- Bloomberg Treasury U.S. T-Bills-1-3 Month Index includes aged U.S. Treasury bills, notes and bonds with a remaining maturity from one up to (but not including) three months. It excludes zero coupon strips.

- Consumer Price Index (CPI) is a measure of prices paid by consumers for a market basket of consumer goods and services. The yearly (or monthly) growth rates represent the inflation rate.

Advisory Persons of Thrivent provide advisory services under a practice name or “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

THRIVENT IS THE MARKETING NAME FOR THRIVENT FINANIAL FOR LUTHERANS. Investment advisory services offered through Thrivent Advisor Network, LLC., a registered investment adviser and a subsidiary of Thrivent.