Navigating Moderation

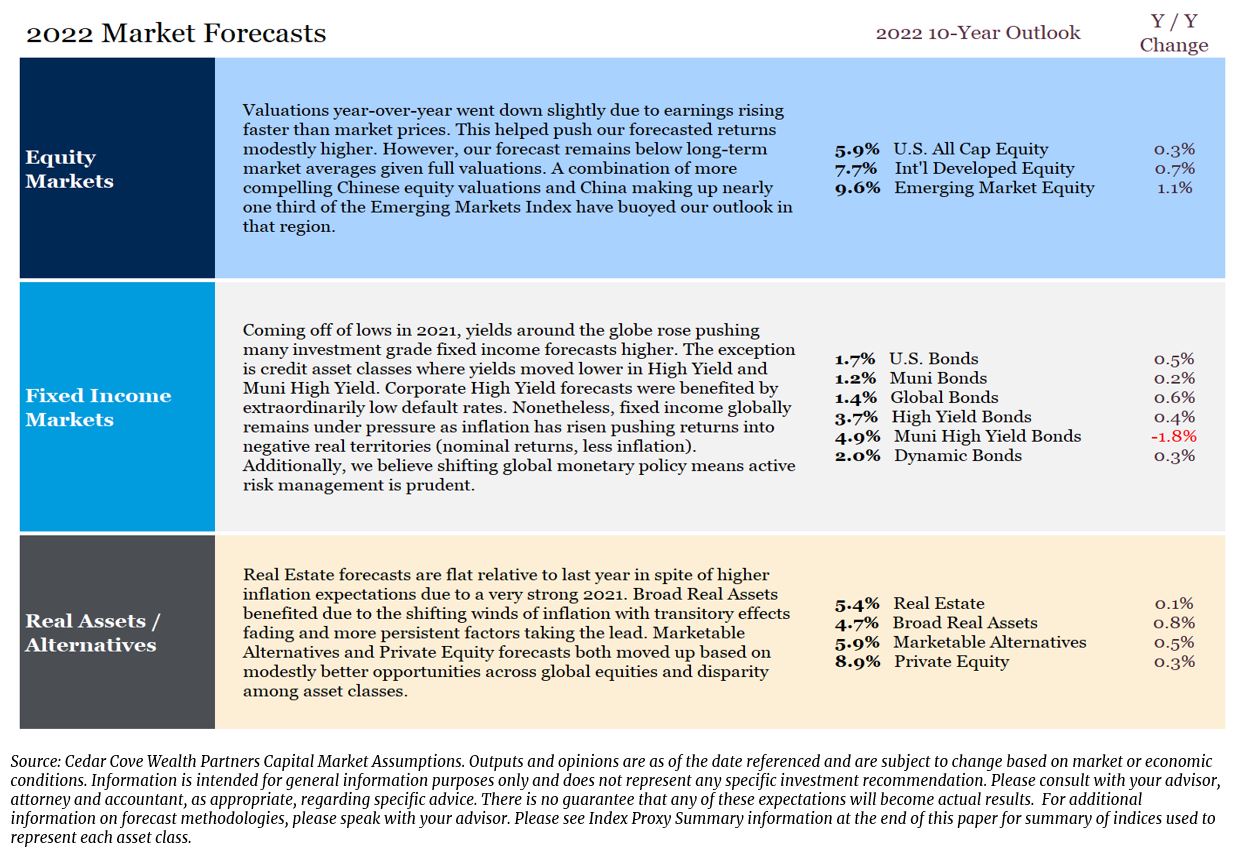

Looking to 2022, we continue to see opportunity, but with far greater moderation after markets, economies and inflation came roaring back in 2020. Our 10-year market forecasts summarized below rose modestly year-over-year; however, our projections remain well below long-term averages.

2022 Themes

In our view, navigating moderation takes preparation, a mental shift and thoughtful risk management. Diverging monetary policies globally, shifting winds in inflation and meeting market expectations around earnings require consideration. With these potential headwinds in mind, we continue to warn against market timing or making narrow “bets.” In today’s environment, where uncertainty is higher, dispersion of outcomes is wider and timing is as important as ever, we believe a thoughtful long-term approach remains the best recipe for success. In our view, the following topics will help provide a framework for how to approach markets in 2022.

From Pandemic to Endemic

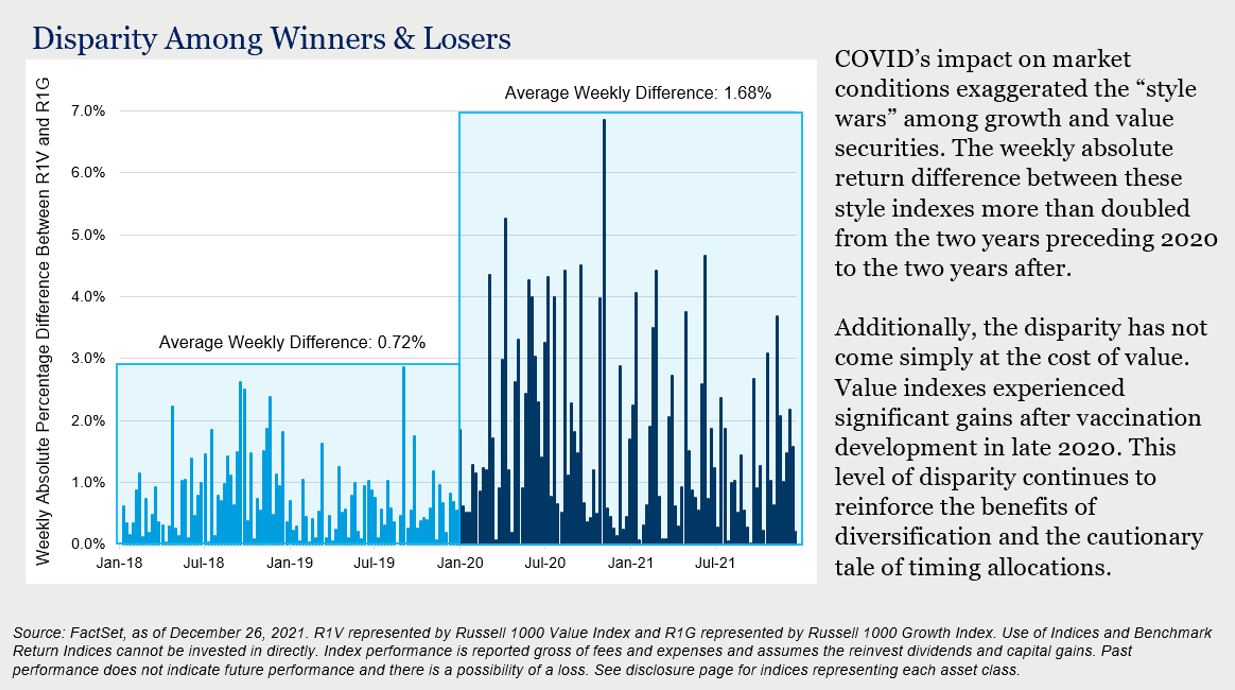

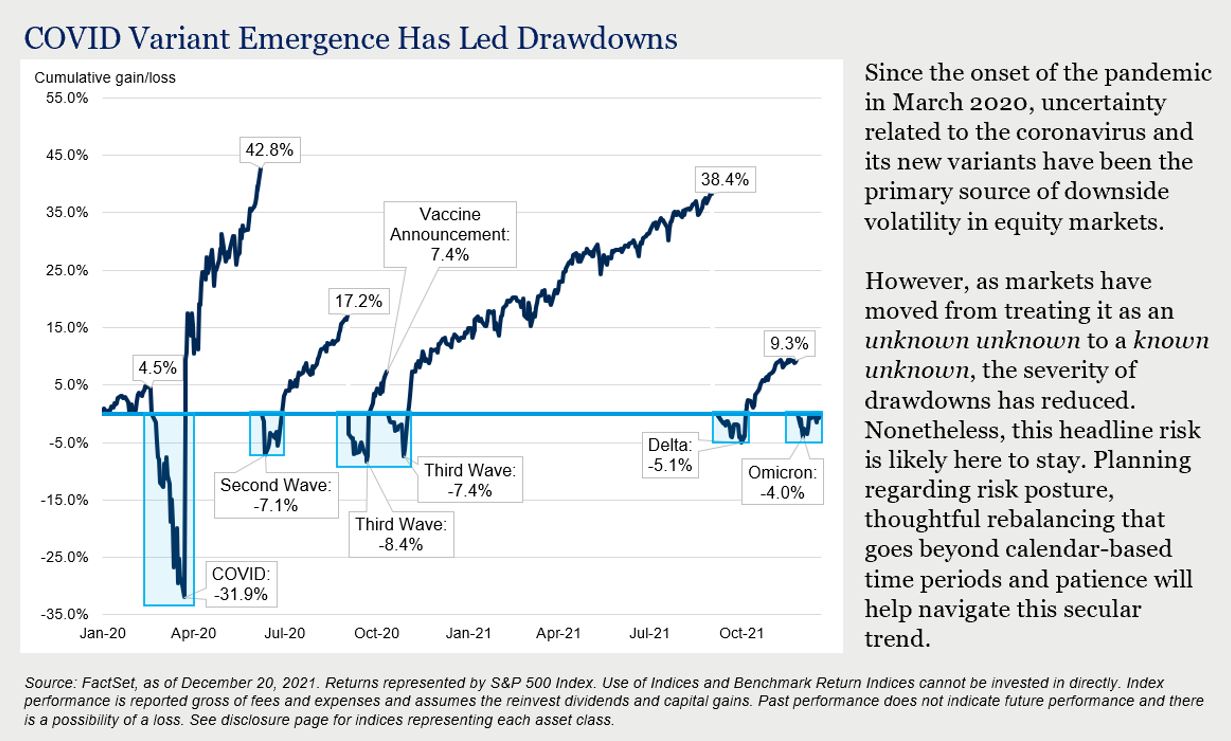

The 1918 Great Influenza wreaked havoc around the world and upended the lives of millions of people. Over 100 years later, variations and mutations of that distant virus are still present in the modern flu. The hopes for fully eradicating COVID have faded and the reality is COVID seems likely to be a secular virus, not a transitory one. This shift in mentality has several implications for investors. Market volatility around current and future unknown variants should be expected and the disparity among the winners and losers in such bouts may be wider than it has been in the past.

Policy Maker Tightrope

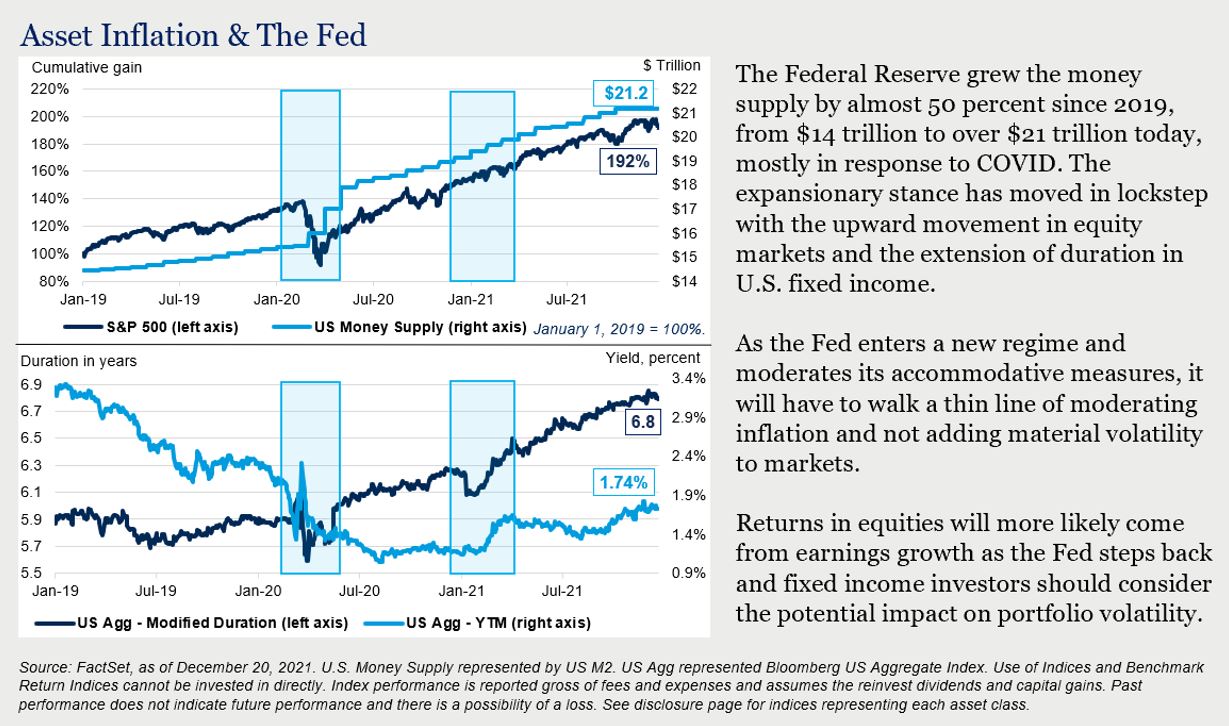

The U.S. Federal Reserve recently acknowledged the persistence of inflation with the majority of FOMC members now expecting to raise the Federal Funds rate three times in 2022(1). In fact, to combat higher inflation, 38 central banks globally already raised rates in 2021(2). However, the era of global coordination among banks is beginning to fade as policy makers evaluate economic growth and price stability in their markets. Recently the European Central Bank said it is unlikely to raise rates in 2022 but will modify its bond buying program(3) while the People’s Bank of China cut rates and injected liquidity into the system in response to slowing growth and market volatility after recent regulation changes. These crosscurrents provide both opportunities and challenges for investors looking ahead.

Inflation: Coming or Going?

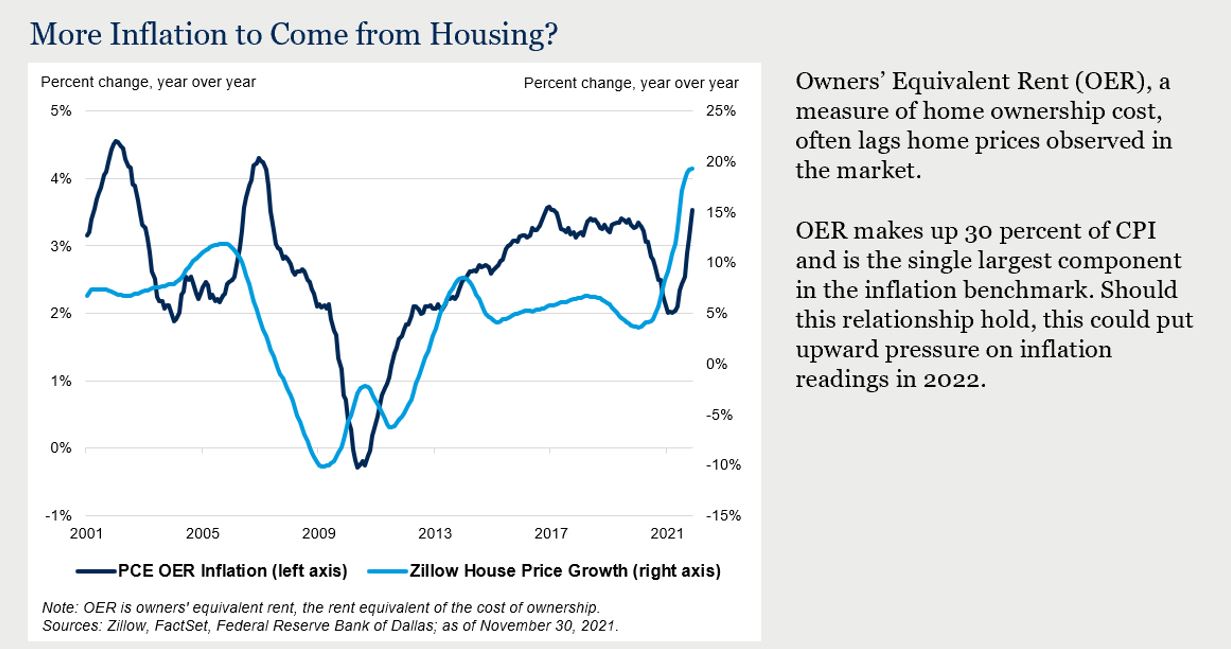

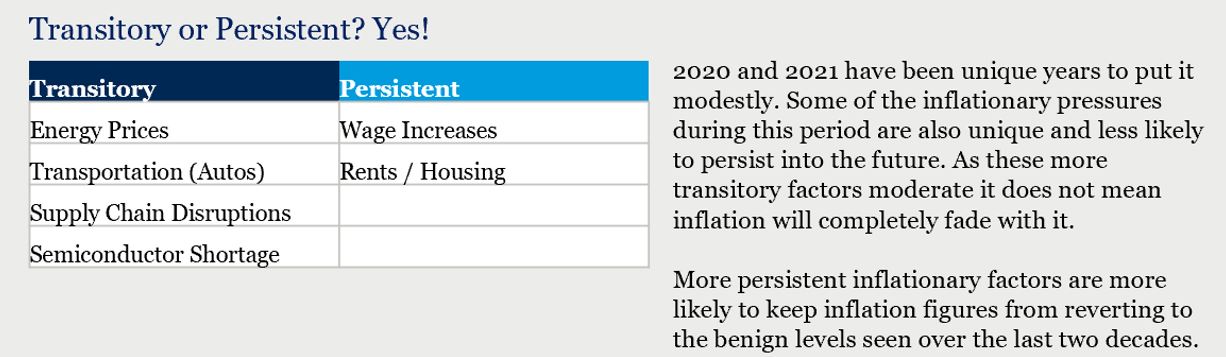

The Consumer Price Index (CPI) rose 6.8 percent year-over-year as of October 31, 2021 – the largest increase since 1982(4). Inflation was initially attributed to the proverbial doors swinging open after shelter in place orders while heightened demand pushed prices higher. Demand remains high with consumer net worth at an all-time high(5) and wages rising(6), but the story moves beyond just the buyer. Supply chain disruptions and fragility, rising energy prices and housing demand all support an environment for above average inflation compared to the most recent two decades.

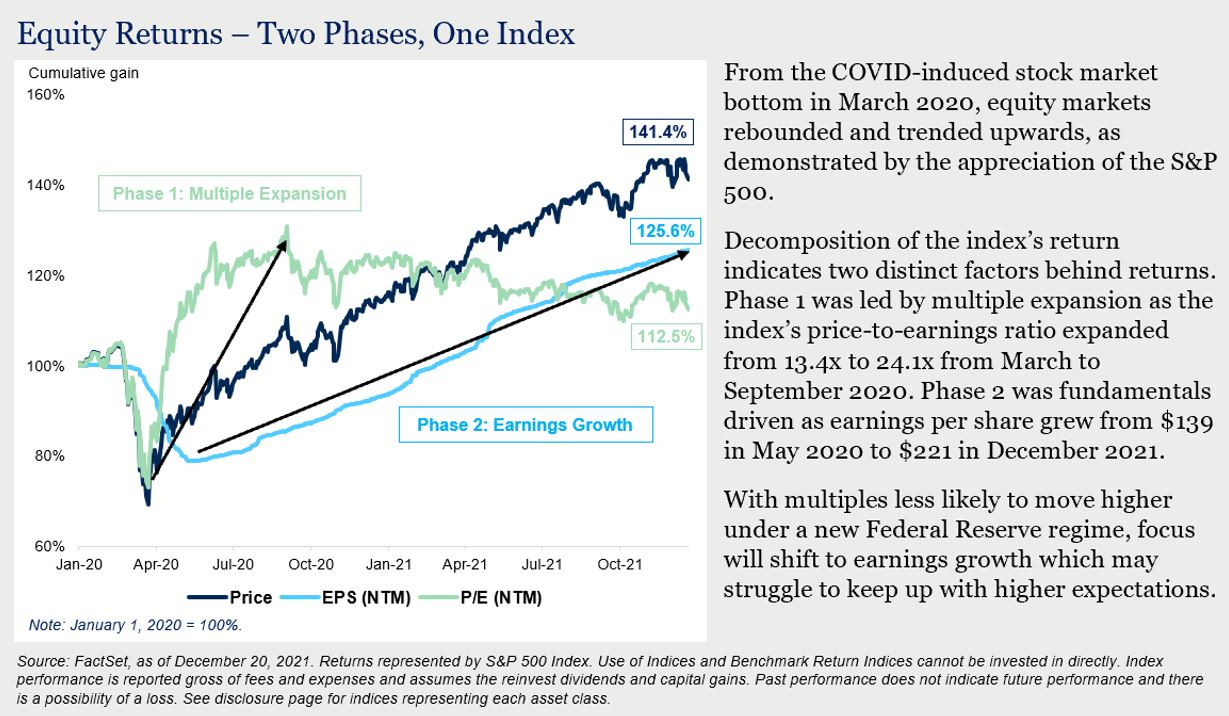

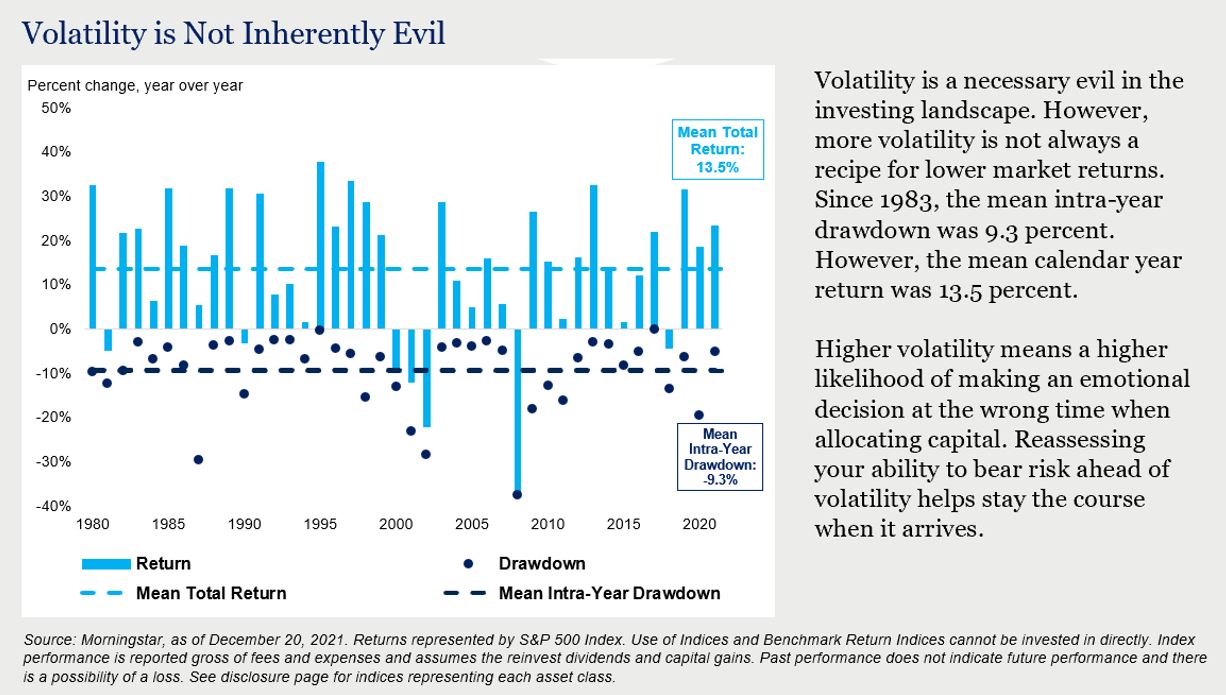

Volatility Ahead: Be comfortable with your risk posture

Domestic equities reached 71 new all-time highs in 2021(7) supported by accommodative monetary policy, a 43 percent earnings increase year-over-year(8) and investors fleeing negative real yields in fixed income as inflation kicked into high gear. However, the steady ascent of equity markets masked the churn beneath the surface. 92 percent of S&P 500 companies experienced a draw-down of at least 10 percent in 2021(9) and the “style-war” between value and growth continued to rage as investors weighed economic re-opening with emerging COVID variants. As we look to 2022, conditions do not appear as favorable for a steady ascent.

Final Thoughts Footnotes

Diverging global monetary policies, changing winds in inflation and meeting market expectations around earnings are likely to impact asset classes. However, navigating a shifting landscape and the potential for greater volatility is not a new task for investors. For 2022, we believe the right mental approach to COVID curveballs, managing fixed income risks in a dynamic environment, fine tuning global equity allocations and broadening inflation related assets to guard against decay will put investors one step closer to achieving their long-term goals.

For more information, please contact any of the professionals at Cedar Cove Wealth Partners.

Footnotes

- CNBC, “The majority of Fed members forecast three interest rate hikes in 2022 to fight inflation,” December 15, 2021, https://www.cnbc.com/2021/12/15/the-majority-of-fed-members-forecast-three-interest-rate-hikes-in-2022-to-fight-inflation.html

- BIS, Central Bank Policy Rates, https://www.bis.org/statistics/cbpol.htm

- MSN, “European Central Bank Cuts Pandemic Bond Buying, but Pledges Further Stimulus,” https://www.msn.com/en-us/money/markets/european-central-bank-leaves-interest-rates-unchanged-cuts-bond-buying-further/ar-AARSmLP?ocid=uxbndlbing

- Federal Reserve Bank of St. Louis, “Consumer Price Index for All Urban Consumers,” https://fred.stlouisfed.org/series/CPIAUCSL

- Federal Reserve Bank of St. Louis, “Household Net Worth,” https://fred.stlouisfed.org/series/BOGZ1FL192090005Q

- Federal Reserve Bank of St. Louis, “Household Net Worth,” https://fred.stlouisfed.org/series/CES0500000003

- Factset, as of December 31, 2021

- Refinitiv, “S&P 500 Earnings Dashboard 21Q3,” https://lipperalpha.refinitiv.com/2021/12/sp-500-earnings-dashboard-3/#

- “Schwab 2022 Market Outlook: Ebb Tide”, Schwab Center for Financial Research

Advisory Persons of Thrivent provide advisory services under a practice name or “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

THRIVENT IS THE MARKETING NAME FOR THRIVENT FINANIAL FOR LUTHERANS. Investment advisory services offered through Thrivent Advisor Network, LLC., a registered investment adviser and a subsidiary of Thrivent.

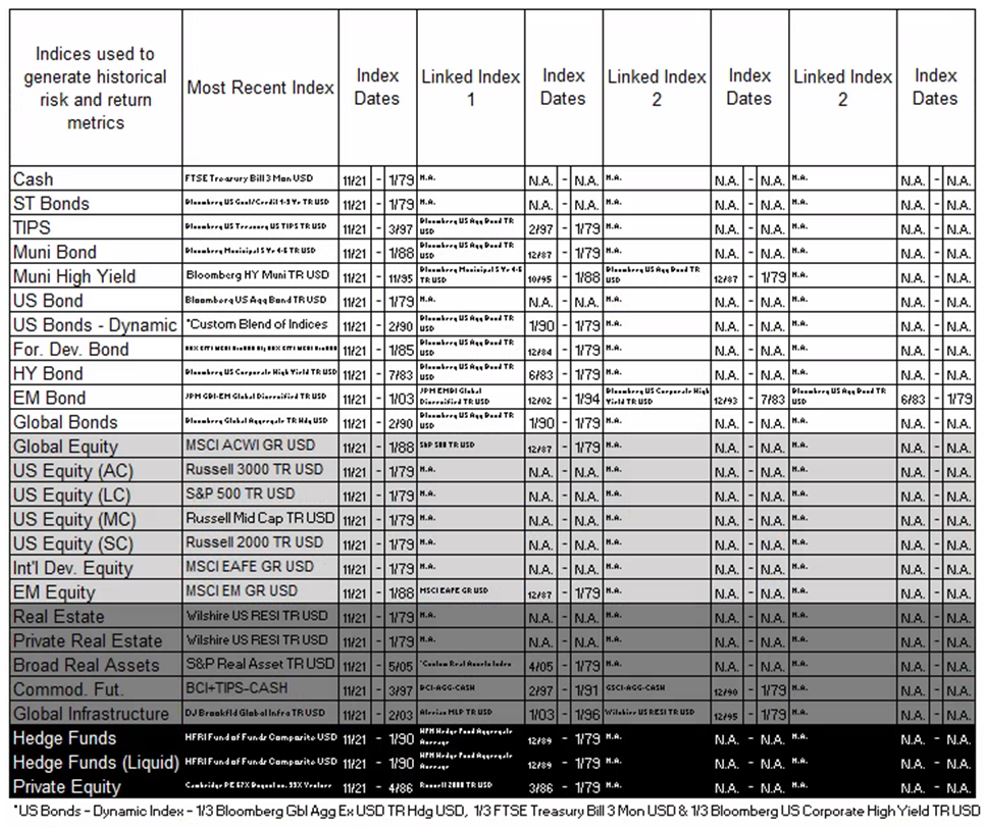

Disclosures and Index Proxies

When referencing asset class returns or statistics, the following indices are used to represent those asset classes, unless otherwise notes. Each index is unmanaged, and investors can not actually invest directly into an index:

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- Russell 1000 Growth measures the performance of those Russell 1000 companies with higher P/B ratios and higher forecasted growth values.

- Russell 1000 Value measures the performance of those Russell 1000 companies with lower P/B ratios and lower forecasted growth values.

- Consumer Price Index is a measure of prices paid by consumers for a market basket of consumer goods and services. The yearly (or monthly) growth rates represent the inflation rate.