Key Observations:

- Financial Markets have priced in a Goldilocks scenario that is vulnerable to a downside surprise.

- Inflation declined in 2023, however the road to the Fed’s 2% target is likely to be bumpy.

- Monetary policy remains restrictive, while Fiscal policy is likely to be accommodative in an election year where dwindling excess savings increase the risk of a recession.

Financial markets are currently pricing in a Goldilocks scenario where inflation falls back to the Fed’s 2% long-term target without causing a recession. The path through 2023 to the current soft-landing consensus paved over significant cross currents that can be summarized with the following three risks:

- above target inflation persists that limits the Fed’s ability to ease monetary policy as currently priced,

- excess consumer savings resulting from COVID fiscal stimulus dwindles by mid-2024, and

- the most predicted recession in history surprises market participants by coming home in 2024.

While these risks can be summarized as the ‘bear case,’ we find that description overly simplistic and inflexible. Rather, it is essential to address the question of how we got here, which follows the most recent pivot in market consensus that occurred last quarter. We will explore the likely economic and market drivers for 2024 including inflation, monetary policy, fiscal policy, and the historical implications of this being an election year.

Inflation

The trajectory of inflation expectations remains the primary driver of both financial markets and monetary policy. A sharp decline in inflation during 2023 boosted market expectations that the Fed could pivot from its restrictive monetary policy and reduce interest rates. However, the path of inflation is highly uncertain with a risk that inflation surprises to the upside due to several structural components, such as the shift towards deglobalization, tight labor markets, and hot wars. Consequently, the road to 2% inflation is likely to make for a bumpy ride.

Monetary Policy

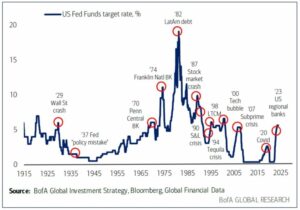

The current consensus for restrictive monetary policy to ease due to a robust economy and falling inflation could lead to an unpleasant surprise if this Goldilocks scenario does not play out. There is also historical precedent for a rate hiking cycle of this magnitude (525 bps) and speed to be negative for risk assets by causing something to break as indicated by red circles in the chart from BofA Global Research. In addition, the Fed has been reducing the money supply from historically high levels, which has led to the first decrease of M2 (1) since the great depression. Reductions in the supply of money, a measure that contributes to financial market liquidity, can impact capital market demand and subsequently reduce price support for stocks. (2)

Fiscal Policy & Elections

On the other hand, fiscal policy has remained accommodating over the same period that monetary policy has been fighting inflation with restrictive rates and reduced liquidity. The immense fiscal support passed during the pandemic contributed to excess savings, which is the most likely contributor to the economic resilience seen in 2023. However, the excess savings are expected to run out in mid-2024. In addition, according to the Congressional Budget Office, federal deficit spending rose 23% in fiscal year 2023 to a historic $1.7 trillion, the largest in history outside of the pandemic.

Mark Twain was noted to have said that, “history doesn’t repeat itself, but it often rhymes”. A phenomenon known as the Presidential election cycle points to the fact that the S&P 500 has risen in every US Presidential election year dating back to 1944, which is now 16 for 16 leading into 2024 (3). President Biden has substantial fiscal firepower available from existing legislation in the CHIPs Act and Inflation Reduction Act (IRA) to pull forward spending into 2024. Additional fiscal stimulus would be inflationary, but it has a long precedent in election years with potential to delay an economic slowdown, the death knell of a reelection campaign. It appears that this pattern may repeat again in the first half of 2024 but is set to encounter the long and variable lags of monetary policy as the Fed maintains its singular focus on price stability.

Concluding Thoughts:

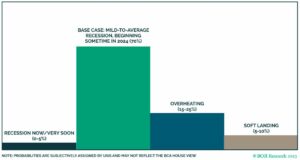

(4)

(4)

The collision of cross currents is likely to surprise many investors, and while we cannot say for certain that our expectations will come to fruition, we can prepare and plan for the wide range of outcomes possible this year. The chart above from BCA highlights this range and generally expresses our primary concern, that a reaccelerating economy is supportive of an inflation surprise that is unlikely to meet the aggressive rate cutting expectation priced into markets, and ultimately creating a challenging environment for equities. While a soft-landing seems to be the consensus position, it is not a destination in and of itself, but rather a point in time along the journey. Our team will continue to monitor the primary risks to consensus as outlined herein, and emphasize thoughtful diversification and prudent risk-management at the portfolio level.

Footnotes

(1) M2 is a measure of the U.S. money stock that includes M1 (currency and coins held by the non-bank public, checkable deposits, and travelers’ checks) plus saviFngs deposits (including money market deposit accounts), small time deposits under $100,000, and shares in retail money market mutual funds.

(2) Ned Davis Research found that since January 31, 1960 to December 31, 2023 when the inflation adjust supply of M2 is falling, markets tends to perform poorly and Treasury markets tend to perform well. (S815 and B500)

(3) Jason Trennert, Founder, Chairman and Chief Investment Strategist, Strategas. Wealthtrack Episode 2030. January 19, 2024.

(4) BCA Research Chart. 2024 Key Views: Suspended Animation. Peta, Doug. BCA Chief US Investment Strategist. December 4, 2023.

Disclosures and Definitions

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities, or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

This communication may include forward looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could’” or the negative of such terms or other variations on such terms or comparable terminology. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially.

Investment advisory services offered through Thrivent Advisor Network, LLC., (herein referred to as “Thrivent”), a registered investment adviser. Clients will separately engage an unaffiliated broker-dealer or custodian to safeguard their investment advisory assets. Review the Thrivent Advisor Network Financial Planning and Consulting Services, Investment Management Services (Non-Wrap) and Wrap-Fee Program brochures (Form ADV Part 2A and 2A Appendix 1 brochures) for a full description of services, fees and expenses, available at Thriventadvisornetwork.com. Thrivent Advisor Network, LLC financial advisors may also be registered representatives of a broker-dealer to offer securities products.

Definitions:

- BCA Research was founded by A. Hamilton Bolton in 1949 in Montreal, Quebec, Canada. The firm is also known by the title of its first publication, The Bank Credit A BCA Research.

- The CHIPS (“Creating Helpful Incentives to Produce Semiconductors”) and Science Actis a U.S. federal statute enacted by the 117th United States Congress and signed into law by President Joe Biden on August 9, 2022. The act authorizes roughly $280 billion in new funding to boost domestic research and manufacturing of semiconductors in the United States, for which it appropriates $52.7 billion.

- COVID (COrona VIrus Disease) is the new name of this disease is coronavirus disease 2019, abbreviated as COVID-19. In COVID-19, ‘CO’ stands for ‘corona,’ ‘VI’ for ‘virus,’ and ‘D’ for the disease. Formerly, this disease was referred to as “2019 novel coronavirus” or “2019-nCoV.”