The Impact of Higher Rates Are Taking Hold

Market Recap

The sanguine April return of headline indexes hides the churn underneath. Equity and fixed income indexes alike posted modestly positive returns overall with year-to-date trends for 2023 continuing in April; longer duration outperformed shorter duration, credit outperformed Treasuries, international developed equity outperformed the U.S. and emerging and commodities took another step back. U.S. Equity returns continue to be driven by big tech, as part of a ‘flight to quality’, with investors finding safety in big tech names such as Apple and Microsoft (1).

However, the long lag and variable impact of higher interest rates are starting to take root. A tour through April headlines including First Republic’s demise and Leading Economic Indicators (LEI) slowing gave renewed confidence to the bears while bulls gravitated to the resiliency of the labor market and early upside surprises in first quarter earnings.

Don’t Bury the Lead

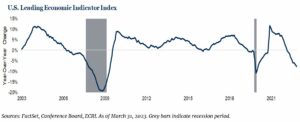

Lagged indicators, such as Gross Domestic Product (GDP) or employment help measure the past but have little predictive value for the future. Leading Economic Indicators (LEI) by contrast seek to proceed economic change by looking further up the value chain. For example, a potential leading indicator of future home inventory is building permits. Unlike the strength of lagged indicators today, leading indicators have been falling.

Historically, four months of falling leading indicators are enough to raise the eyebrows of economists for a potential economic slowdown. In fact, since 1993 the longest consecutive fall for the LEI index without a recession occurring was three months (2).

Leading up to the Global Financial Crisis, the LEI index fell 10 of the 12 months prior to the start of the recession in December 2007, eight months consecutively (2). Prior to the recession in February 2001, the LEI index fell eight of the preceding 12 months, five months consecutively (2). As of March 2023, the LEI index has fallen 12 of the last 12 months (2). Where there is no economic law stating that a falling LEI index produces a recession, we believe it would be unwise to interpret the recent equity markets rally as an all-clear signal. Adding to this complexity is the recent volatility we have seen in the banking sector.

The Banking Effect

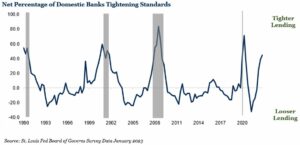

An important part of the economic engine is lending. People and businesses often borrow money so they can purchase items. For example, individuals often do not pay all cash for a house or a car, they finance it. Businesses often do not pay all cash for inventory or equipment, they finance it. Rising interest rates have made loans more expensive, however, the additional added effect of stress in the banking sector has also made loans less available.

The effect of tighter standards in banking is less lending, which is a potential headwind for economic growth. The recent news of First Republic being sold to JPMorgan underscores the potential for continued tightening of lending standards putting additional pressure on the economy. During the press conference after the FOMC’s March rate hike, Fed Chair Powell noted that the effect of tighter lending standards in banking would work, in principle, as being the equivalent of a rate hike (3).

Outlook

Our 2023 outlook, Breaking up with TINA (There is No Alternative), surmised the transition away from a zero-bound interest rate economy and market was likely to be a bumpy one. To that end our continued volatility theme helped underpin our thoughts around risk management and building resilient portfolios meant to weather a variety of economic scenarios. So, while the risk of economic contraction as we outlined above may be rising, this is not an unanticipated event. Additionally, our theme of moderating inflation appears on track with recent data showing signs of material improvement. These views reinforce our opinion that the Federal Reserve is nearing the end of its rate-hiking cycle and our proactive updates at the beginning of 2023 continue to put us in a strong position for the markets ahead.

For more information, please contact any of the professionals at Cedar Cove Wealth Partners.

Footnotes

- Banking Turmoil Drives Investors to mega-cap tech, S&P Global, March 29, 2023

- Conference Board, Leading Economic Index as of March 31, 2023

- Federal Reserve Transcript of Chair Powell’s Press Conference, March 22, 2023

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

- MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

- MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

- Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

- Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

- FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

- Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

- The Leading Economic Index (LEI) is an index published monthly by The Conference Board. It is used to predict the direction of global economic movements in future months. The index is composed of 10 economic components whose changes tend to precede changes in the overall economy.

- The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy.

- Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

- The Bloomberg Commodity® Index (BCOM) is a broadly diversified commodity price index distributed by Bloomberg Index Services Limited.

This material is provided for informational purposes only and is not solely intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Advisory services offered through Thrivent Advisor Network, LLC.

This communication may include forward looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could’” or the negative of such terms or other variations on such terms or comparable terminology. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities, or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

Investment advisory services offered through Thrivent Advisor Network, LLC., (herein referred to as “Thrivent”), a registered investment adviser. Clients will separately engage an unaffiliated broker-dealer or custodian to safeguard their investment advisory assets. Review the Thrivent Advisor Network Financial Planning and Consulting Services, Investment Management Services (Non-Wrap) and Wrap-Fee Program brochures (Form ADV Part 2A and 2A Appendix 1 brochures) for a full description of services, fees and expenses, available at Thriventadvisornetwork.com. Thrivent Advisor Network, LLC financial advisors may also be registered representatives of a broker-dealer to offer securities products.

Certain Thrivent Advisor Network LLC advisors may also be registered representatives of a broker-dealer to offer securities products. Advisory Persons of Thrivent provide advisory services under a “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser. Please visit our website www.thriventadvisornetwork.com for important disclosures.

The opinions expressed are subject to change as subsequent conditions vary. Reliance upon information in this material is at the sole discretion of the reader. International investing involves additional risks, including risks related to foreign currency, limited liquidity, government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. The two main risks related to fixed income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. Index performance is shown for illustrative purposes only.

Advisory Persons of Thrivent provide advisory services under a “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser. Cedar Cove Wealth Partners and Thrivent Advisor Network, LLC are not affiliated companies. Information in this message is for the intended recipient[s] only. Please visit our website www.cedarcovewealth.com for important disclosures.

Securities offered through Purshe Kaplan Sterling Investments (“PKS”), Member FINRA/SIPC. PKS is headquartered at 80 State Street, Albany, NY 12207. PKS and Cedar Cove Wealth Partners are not affiliated companies.