Market Commentary

Wait and See

April 2025

Summary

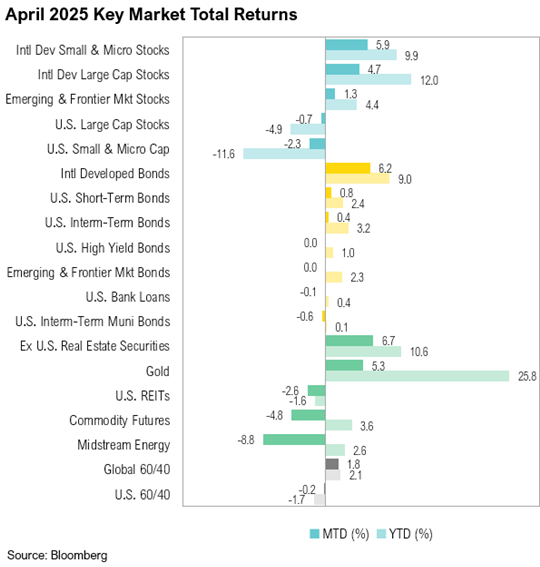

- Despite notable intramonth swings in both directions, U.S. large-cap stocks ended April down 0.7% while U.S. small-cap stocks declined by 2.3%. U.S. intermediate-term bonds gained 0.4%.

- Investor sentiment weakened. Nearly half of Bank of America survey respondents now expect a recession this year, and bearish sentiment in the AAII survey stayed above 50% for a record-breaking 10 straight weeks.

- Despite weakening consumer sentiment, spending held up—likely due to consumers front-loading purchases ahead of anticipated tariff-driven price hikes, highlighting the gap between soft and hard data.

- Earnings call transcripts indicate that many companies and their customers are taking a “wait-and-see” approach to tariffs, delaying further investment and business decisions until trade policy becomes clearer.

Overview

Markets fluctuated throughout April in response to tariff announcements. Despite notable intramonth swings in both directions, U.S. large-cap stocks, as represented by the S&P 500, ended the month down just 0.7%. The Russell 2000 Index, which tracks U.S. small-cap stocks, declined 2.3%. U.S. intermediate-term bonds, as measured by the Bloomberg U.S. Aggregate Bond Index, gained 0.4% in April.

Headline inflation eased to 2.4% year-over-year in March while core inflation dropped below 3.0% (to 2.8%) for the first time since April 2021.1 Lower energy costs were a key contributor to easing price pressures while shelter inflation rose by 0.2% month-over-month, rising by the slowest pace since August 2021. Despite easing prices, consumers’ inflation expectations skyrocketed in April, rising to 6.5%.2

Preliminary estimates for first-quarter GDP showed the U.S. economy contracting at an annualized rate of 0.3% quarter-over-quarter.3 This slowdown was largely attributed to a sharp rise in imports ahead of anticipated tariffs, with imports soaring 41.3% in the first quarter. Consumer spending rose 1.8%, while government spending declined by 1.4%.

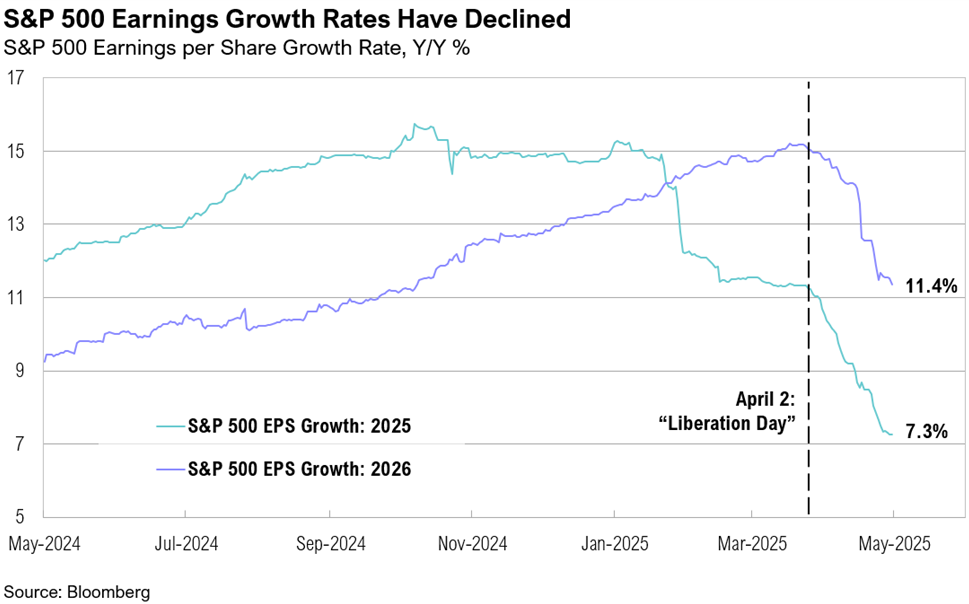

First-quarter earnings season kicked off in April, with over 70% of S&P 500 companies having reported results. As of the end of the month, the blended year-over-year earnings growth rate for the S&P 500 stood at 12.8%, a notable improvement from the 7.2% estimate at the end of March.4 However, full-year 2025 earnings growth estimates declined over the month, from 11.2% to 7.3%.

Wait and See

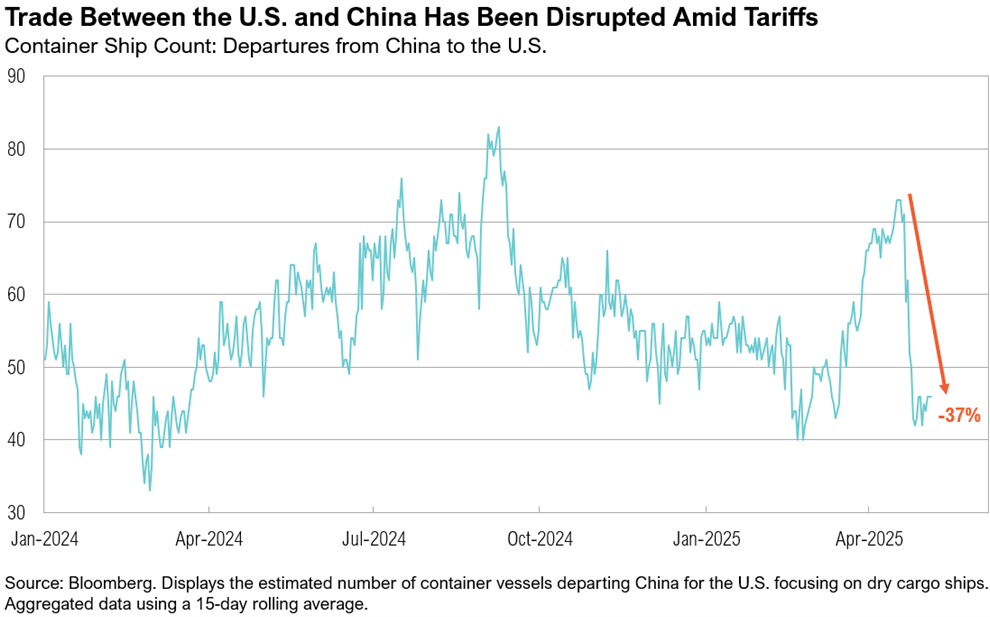

On April 2, President Trump announced sweeping tariffs: a 10% baseline on nearly all imports and higher rates targeting 60 specific countries.5 He dubbed it “Liberation Day,” framing the move as a response to trade imbalances and a push to bolster domestic manufacturing. This brought the average U.S. tariff rate to 22.5%—the highest level in over a century. Markets reacted swiftly and sharply—longer-term Treasury yields spiked while U.S. and international equity markets tumbled. Just over a week later, on April 9, Trump announced a 90-day pause on reciprocal tariffs with China as the sole exception.6 By the end of April, amid escalating tit-for-tat measures, the average trade-weighted U.S. tariff rate on Chinese exports had climbed to 145% while China’s average trade-weighted tariff rate on U.S. exports rose to 125%.7 The result was a sharp disruption in trade: the number of container ships departing from China to the U.S. dropped by 37% between April 18 and April 30.8

Throughout April, markets moved sharply in response to tariff developments. U.S. large-cap stocks fell 12% between April 2 and April 8. Then, on April 9, following the announcement of a 90-day tariff pause, they rebounded 10%, marking the third-largest one-day gain since World War II. Treasury markets experienced similarly dramatic shifts. Between April 4 and April 11, the 10-year Treasury yield rose 0.5% to 4.5%, its largest weekly increase since 2001. Over the same period, the 30-year yield climbed 0.5% to 4.9%, the biggest five-day gain since April 1987.

Bond market volatility appears to have played a key role in the decision to pause tariff escalation. On April 10, Kevin Hassett, director of the U.S. National Economic Council, noted that:

“There’s no doubt that the Treasury market made it so that the decision about the time to move [on the tariff pause] was made with, I think perhaps, a little more urgency.”9

Investor sentiment remained bearish throughout the month. For a record tenth consecutive week, more than 50% of respondents to the American Association of Individual Investors (AAII) survey reported bearish views. Yet, actual positioning suggested investors were also taking more of a wait-and-see approach as actual equity exposures did not drop nearly as much as the “soft” survey data would suggest. The National Association of Active Investment Managers (NAAIM) Exposure Index ended April at 60%, well above its four-week average of 48%, and the AAII Asset Allocation Survey showed average investor portfolios holding 65% in U.S. stocks.10,11

Meanwhile, concerns about a global recession intensified. According to the April Bank of America Fund Manager Survey, 80% of respondents cited a trade-war-triggered global recession as the top “tail risk” (a rare but potentially severe event).12 42% of survey respondents now expect a recession—the most since June 2023 and the fourth-highest reading over the past 20 years.12 Meanwhile, betting markets show the probability of a recession this year hovering just above 50%.13,14

The disconnect between soft data (surveys) and hard data (actual indicators) intensified over the month. While consumer sentiment deteriorated in April, retail sales and personal spending remained strong. The University of Michigan’s consumer sentiment index fell to 52.2, the lowest reading since June 2022 while the Conference Board’s consumer confidence index dropped to 86, the weakest since August 2020.15 Its expectations index fell to 54.4, a 13-year low. In contrast, hard economic data reflected a resilient consumer. March retail sales rose 1.4% month-over-month—the largest increase in more than two years—and personal spending rose 0.7%. However, some of this spending likely reflected consumers front-loading purchases ahead of expected tariff-related price increases. Should tariff uncertainty continue to impact supply chains and pricing—or should tariffs be expeditiously rolled back—a convergence between soft and hard data is likely.

Tariff-related uncertainty dominated corporate earnings calls throughout April. According to Barron’s, mentions of “tariffs” rose 132% over the past 90 days compared to the previous quarter, surpassing levels seen during the 2018 trade tensions.16 Additionally, recent corporate earnings reports expose the challenge in navigating this landscape. Many companies adopted a “wait-and-see” approach to tariffs, delaying further investment and/or significant business decisions until trade policy becomes clearer. Some examples are below.

According to Citigroup CEO Jane Fraser:

“While our corporate and consumer clients are resilient and in good financial health, the world is in a wait-and-see mode and is facing a more negative macroeconomic outlook than anyone had anticipated at the beginning of the year.”17

Goldman Sachs also noted growing uncertainty and concern about the impact of the trade wars:

“Our clients, including corporate CEOs and institutional investors, are concerned by the significant near-term and longer-term uncertainty that has constrained their ability to make important decisions.”18

M&T Bank CFO, Daryl Bible, noted that customers are “on hold” until further clarity emerges regarding tariffs:

“Business-wise, our customers really wanted to make a lot of investments. They want to do acquisitions. They are just really on pause right now. I think it’s just a lack of confidence. They don’t know what the rules of the road are right now.”19

Similarly, Regions Financial CFO David Jackson Turner said in the company’s earnings call that:

“Customers are delaying investment decisions pending further clarity.”20

Going a step further, Delta Air Lines, American Airlines, Ford, General Motors, P&G, Pepsico, UPS, and Thermo Fisher were among the list of companies that suspended earnings guidance altogether given the uncertain macro backdrop.21

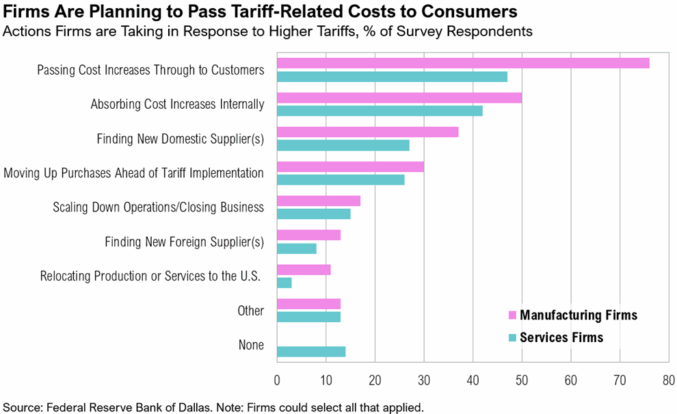

Regardless of how things play out, businesses will face a period of intense disruption. On April 28, the Federal Reserve Bank of Dallas released a survey detailing how companies are responding to higher tariffs. The most common response was passing cost increases on to customers, with nearly 80% of manufacturing firms and 50% of services firms opting to do so.22

Markets

Despite wild fluctuations throughout the month, U.S. large-cap stocks ended April down only 0.7% while U.S. small-cap stocks declined by 2.3%. International markets fared better than their U.S. counterparts for the fourth consecutive month. International developed (ex-U.S.) small cap stocks gained 5.9% while international developed market large cap stocks ended April up 4.7%. A similar pattern occurred in fixed income markets: international developed market bonds gained 6.2% over the month, notably outperforming U.S. intermediate-term bonds, which gained only 0.4%. High-yield credit spreads spiked to 4.3% in mid-April on tariff uncertainty, before easing to end the month back at 3.5%. Despite the volatility, credit spreads remained tight relative to history.

Gold, which gained 5.3% in April and is up nearly 26% year-to-date, reached a new record high of $3,434 on April 21 as tariff uncertainty spurred demand for safe-haven assets. West Texas Intermediate (WTI) crude oil ended April below $60 per barrel, dropping to $58, the lowest level since January 2021.

Looking Forward

The administration is encouraging consumers, businesses, and markets to look beyond the near-term pain posed by tariff consequences, focusing instead on the potential boost in small business spending, domestic manufacturing, and capital investment that may result. As long as markets see sufficient evidence that this approach is working, broader disruptions may remain contained. However, if these efforts falter, the U.S. economic adjustment will likely be more painful, and markets may need more time to adjust, creating additional volatility. Chair Powell spoke for everyone in the May 7 FOMC press conference when he said: “Everyone is just waiting to see how developments play out… and I can’t really give you a timeframe on that.”23

Disclosures

IMPORTANT: Advisory Person(s) may use proprietary financial planning tools, calculators and third-party tools and materials (“Third-Party Materials”) to develop your financial planning recommendations. The projections or other information generated by Third-Party Materials regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results may vary with each use and over time. Thrivent Advisor Network, LLC and its advisors do not provide legal, accounting or tax advice. Consult your attorney and or tax professional regarding these situations.

The return assumptions in Third-Party Materials are not reflective of any specific product, and do not include any fees or expenses that may be incurred by investing in specific products. The actual returns of a specific product may be more or less than the returns used. It is not possible to directly invest in an index. Financial forecasts, rates of return, risk, inflation, and other assumptions may be used as the basis for illustrations. They should not be considered a guarantee of future performance or a guarantee of achieving overall financial objectives. Past performance is not a guarantee or a predictor of future results of either the indices or any particular investment. Investing involves risks, including the possible loss of principal.

This communication may include forward looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could’” or the negative of such terms or other variations on such terms or comparable terminology. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially.

Investment advisory services offered through Thrivent Advisor Network, LLC., (herein referred to as “TAN”), a registered investment adviser. Clients will separately engage an unaffiliated broker-dealer or custodian to safeguard their investment advisory assets. Review the Thrivent Advisor Network Financial Planning and Consulting Services, Investment Management Services (Non-Wrap) and Wrap-Fee Program brochures (Form ADV Part 2A and 2A Appendix 1 brochures) for a full description of services, fees and expenses, available at Thriventadvisornetwork.com. Thrivent Advisor Network, LLC financial advisors may also be registered representatives of a broker-dealer to offer securities products. Visit Investment Adviser Public Disclosures or FINRA’s Broker Check for more information about our Advisory Persons.

Advisory Persons of TAN provide advisory services under a “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser. Cedar Cove Wealth Partners and Thrivent Advisor Network, LLC are not affiliated companies.

Securities offered through Thrivent Investment Management Inc. (“TIMI”), member FINRA and SIPC, and a subsidiary of Thrivent, the marketing name for Thrivent Financial for Lutherans. Thrivent.com/disclosures. TIMI and Cedar Cove Wealth Partners are not affiliated companies.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities, or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index comprised of the common stocks of 500 leading companies in leading industries of the U.S. economy. You cannot invest directly in an index.

The Russell 2000® Index measures the performance of the 2,000 smaller companies that are included in the Russell 3000® Index, which itself is made up of nearly all U.S. stocks. The Russell 2000® is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market.

The AAII Sentiment Survey is a weekly survey conducted by the American Association of Individual Investors, a non-profit organization dedicated to providing investment education and resources to individual investors. The survey has been conducted since 1987 and polls AAII members on their outlook for the stock market over the next six months. Respondents can choose from three options: bullish, bearish, or neutral. AAII members are asked to vote once a week, so the poll gives a clear picture of both short-term and long-term feelings, as well as changes in the survey data over time.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

FRED (Federal Reserve Economic Data) is an online database consisting of hundreds of thousands of economic data time series from scores of national, international, public, and private sources.

West Texas Intermediate Index (WTI), is the main oil benchmark for North America as it is sourced from the United States, primarily from the Permian Basin. The oil comes mainly from Texas.

Citations

1. FRED: https://fred.stlouisfed.org/series/CPILFESL#

2. Trading Economics: https://tradingeconomics.com/united-states/michigan-inflation-expectations

3. BEA: https://www.bea.gov/sites/default/files/2025-04/gdp1q25-adv.pdf

4. FactSet: https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_050225A.pdf

5. NPR: https://www.npr.org/2025/04/02/nx-s1-5345802/trump-tariffs-liberation-day

6. CNN: https://edition.cnn.com/2025/04/09/business/reciprocal-tariff-pause-trump

7. New York Times: https://www.nytimes.com/2025/04/11/business/china-tariffs-125.html

8. CNBC: https://www.cnbc.com/2025/04/22/busiest-us-ports-see-big-drop-in-chinese-freight-vessel-traffic.html

9. CNBC: https://www.cnbc.com/2025/04/10/china-trump-tariffs-live-updates.html

10. AAII: https://www.aaii.com/sentimentsurvey

11. NAAIM: https://naaim.org/programs/naaim-exposure-index/

12. TrustNet: https://www.trustnet.com/News/13445706/aprils-bofa-fund-manager-survey-the-fifth-most-bearish-in-25-years/fund/fund/sectors

13. Kalshi: https://kalshi.com/markets/kxrecssnber/recession

14. Polymarket: https://polymarket.com/event/us-recession-in-2025

15. Trading Economics: https://tradingeconomics.com/united-states/consumer-confidence

16. Barron’s: https://www.barrons.com/articles/tariffs-earnings-calls-stock-ccab0e3b

17. Citigroup: https://www.citigroup.com/rcs/citigpa/storage/public/Earnings/Q12025/transcript.pdf

18. Investing.com: https://www.investing.com/news/transcripts/earnings-call-transcript-goldman-sachs-beats-q1-2025-forecasts-stock-rises-93CH-3983899

19. Seeking Alpha: https://seekingalpha.com/article/4775014-m-and-t-bank-corporation-mtb-q1-2025-earnings-call-transcript

20. Seeking Alpha: https://seekingalpha.com/article/4775983-regions-financial-corporation-rf-q1-2025-earnings-call-transcript

21. Forbes: https://www.forbes.com/sites/tylerroush/2025/05/08/toyota-says-tariffs-will-cut-profits-by-20-joining-these-companies-warning-of-tariff-impacts/

22. Federal Reserve Bank of Dallas: https://www.dallasfed.org/research/surveys/tbos/2025/2504q#tab-tssos

23. Federal Reserve: https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20250507.pdf