New catalysts provided fuel to the fires of inflation and volatility

Key Observations

- Positive macroeconomic news in early February was overshadowed by Russia’s invasion of Ukraine during the last week of the month. Markets were broadly lower, with real assets being the exception.

- Economic sanctions on Russia continue to pressure commodity prices and inflation globally which, paired with escalating uncertainty, will likely affect central bank positioning. Additional information is available in our piece, Market Alert: Russia Invades Ukraine

- As 2022 evolves, the themes of inflation and market volatility remain evident – although from unforeseen developments. We continue to expect moderation with the ongoing recovery, with a positive view of global growth and see a near-term recession as unlikely.

Market Recap

While February began with eyes on Fed Chairman Powell’s hawkish stance, inflation and a focus on the job market, the resounding theme was Russia’s invasion of Ukraine during the last week of the month. As this evolved from a low likelihood event to a distressing reality, markets adopted a risk-off stance. As we outlined in our 2022 Outlook, volatility would be the recurring theme for the year. That said, we certainly did not foresee armed conflict as a driving factor.

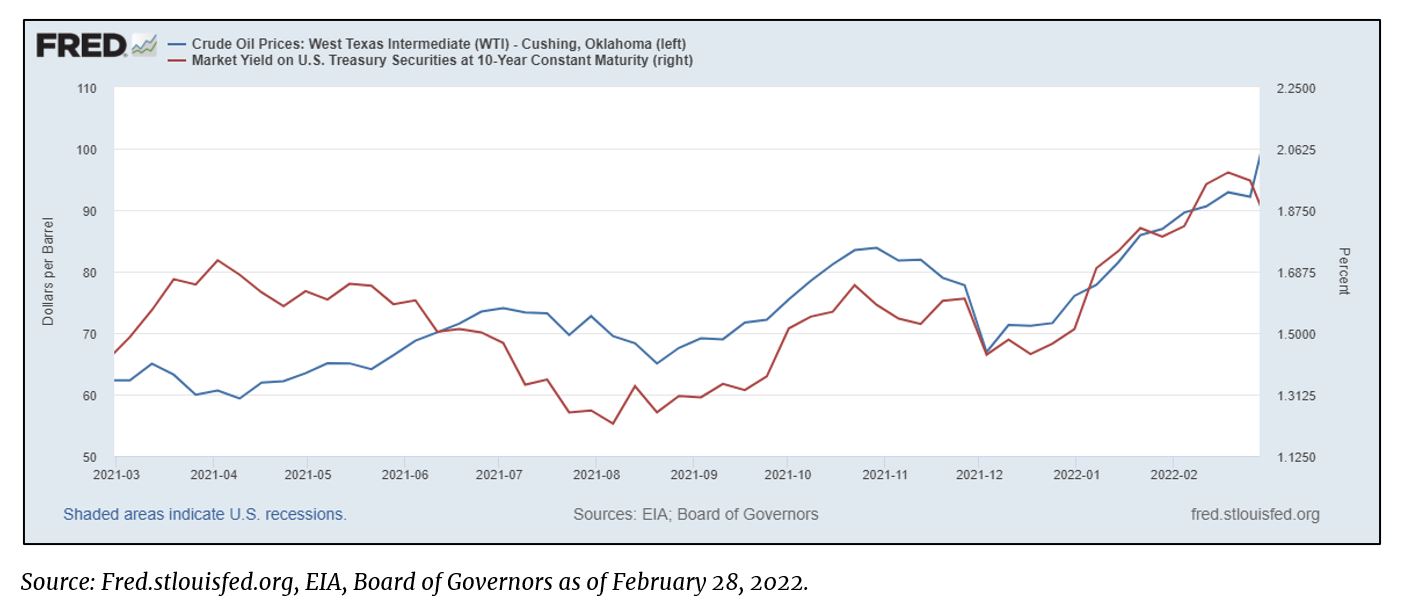

Markets trended lower in February, further adding to January’s losses across asset classes. Equity markets were broadly negative, with the S&P 500 and MSCI Emerging Markets index each down -3 percent, while the small-cap Russell 2000 gained 1.1 percent. Lurking below these monthly numbers was significant volatility, as the VIX index spiked to 31 from an intra-month low of 20. Fixed income markets were lower in the first half of the month as interest rates rose, recovering some ground later; the Bloomberg U.S. Aggregate index was 1.1 percent lower. The U.S. 10-year Treasury yield reached a post-pandemic high of 2.05 percent and subsequently dropped to 1.84 percent, roughly in line with where it began the month. Notably, crude prices added to recent gains driven by uncertainty regarding sanctions on Russia, a major crude exporter. This pushed oil toward $100/barrel, the highest level seen since 2014. Energy and real asset names benefited from this acceleration in the prices of oil and other commodities, with the Bloomberg Commodity index gaining 6.2 percent(1).

Crude Prices and Treasury Yields Have Trended Together – Until Now

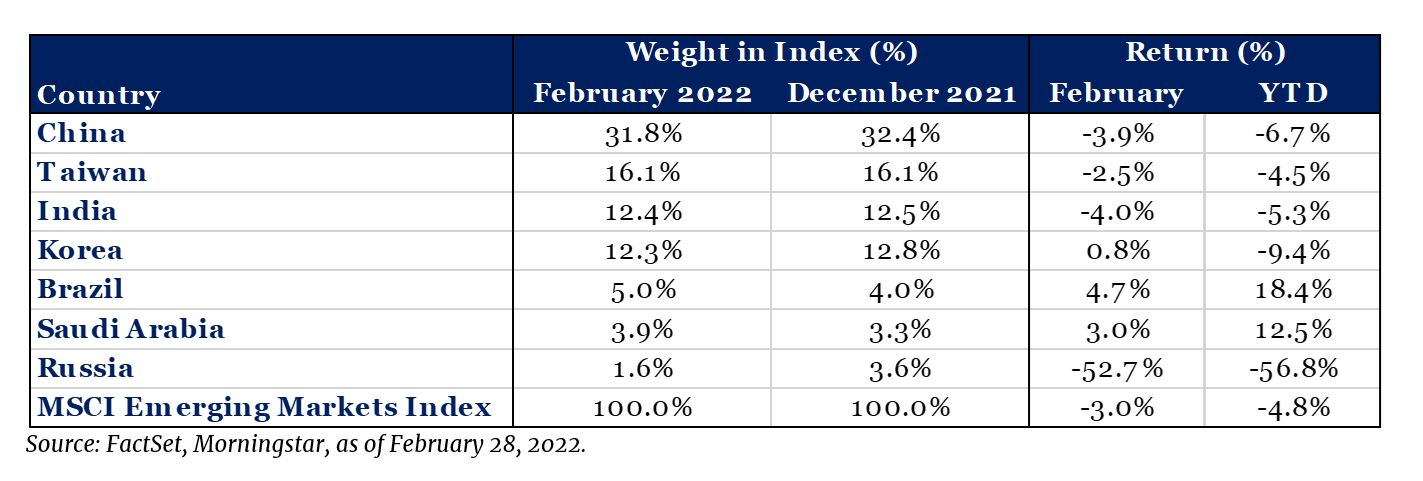

Russia’s Role in Portfolios

Although Russia is a major commodity supplier to the rest of the world, particularly Europe, its role in investment portfolios is muted. The drawdown in Russian equities led to a halving in its size in the MSCI Emerging Markets index. Additionally, index providers such as MSCI began discussing the removal of Russian equities from indices, given ongoing market closures that made them entirely illiquid(2). This will boost the relative size and importance of other regions in indices. Of note are Brazil and Saudi Arabia, which have benefited from the rise in crude oil and commodity prices. Their roles have been further magnified by weakness in other emerging markets.

While geopolitics remain at the forefront of attention, the gears of the U.S. economy continue to churn. Despite the economic disruption wrought by the omicron variant, the job market showed strength, gaining 678,000 jobs in February, more than 200,000 above the forecasted estimated, with 92,000 additional jobs in net revisions to the prior two months(3). Strength in consumer spending was another positive factor, as retail sales grew 3.8 percent in January, compared to a deceleration of -2.5 percent in December(4). Given the central role of consumers in the economy, this strength bodes well for continued recovery. Further evidence of economic strength was provided by the S&P 500 showing 30.7 percent earnings growth for the fourth quarter of 2021(5). The February CPI number of 7.9 percent matched the 7.9 percent forecast but was higher than January’s 7.5 percent reading(6). Further prospects of high inflation will be a factor in the Fed’s rate decision in coming months, especially given uncertainty regarding Russia, elevated market volatility and recent trends in commodity prices.

Outlook

Given the rapidly evolving nature of the situation in Ukraine, we continue to keep a keen eye on additional developments. Our thoughts are with those affected by this conflict and others around the world. As we outlined in our piece, Market Alert: Russia Invades Ukraine, the key takeaways are the upside risk to inflation and Russia’s relatively muted role in investment portfolios. Although elevated oil and natural gas prices will further stoke inflation, the heightened risk arising from the conflict in Ukraine may give the Fed and its peers grounds to temper their recently hawkish tone.

We continue to adhere to the themes we discussed in our 2022 Outlook, namely, preparing for volatility and inflation, as well as policy makers walking a tightrope amidst an evolving landscape. Investing for the long-term in a volatile environment remains key, and our 10-year outlook and capital markets assumptions remain consistent with those outlined at the outset of this year.

As always, should you have additional questions, please reach out to any of the professionals at Cedar Cove Wealth Partners.

Footnotes

- Factset, Morningstar Direct

- WSJ: MSCI Signals Potential Exclusion of Russia From Influential Indexes (wsj.com)

- S. Bureau of Labor Statistics

- S Census Bureau

- FactSet

- S. Bureau of Labor Statistics, Trading Economics

Disclosures and Definitions

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- The MSCI Emerging Markets index captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

- The CBOE Volatility Index (VIX) measures the expected short-term volatility in the S&P 500 index, based on S&P 500 prices of index options.

- The Bloomberg U.S. Aggregate index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

- The Bloomberg Commodity index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

- Consumer Price Index (CPI) is a measure of prices paid by consumers for a market basket of consumer goods and services. The yearly (or monthly) growth rates represent the inflation rate.

- MSCI Brazil Index is designed to measure the performance of the large and mid-cap segments of the Brazilian market. With 50 constituents, the index covers about 85% of the Brazilian equity universe.

- Bloomberg Global Aggregate Bond Index measures the performance of the global investment grade, fixed-rate bond markets. The benchmark includes government, government-related and corporate bonds, as well as asset-backed, mortgage-backed and commercial mortgage-backed securities from both developed and emerging markets issuers.

Advisory Persons of Thrivent provide advisory services under a practice name or “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

THRIVENT IS THE MARKETING NAME FOR THRIVENT FINANIAL FOR LUTHERANS. Investment advisory services offered through Thrivent Advisor Network, LLC., a registered investment adviser and a subsidiary of Thrivent.