Treasury yields surge while equity prices climb higher amid consumer strength

Key Observations

- The Treasury curve steepened during the month with a sharp rise in the 10-year and 30-year yields, pushing both to pre-pandemic levels.

- Equities rallied, notably small cap and value stocks, amid more vaccine progress and the anticipation of more stimulus.

- Strong February retail sales data might suggest that consumers are poised to spend stimulus checks and other savings that have accumulated during the pandemic-induced lockdown.

Market Recap

While trading frenzies and short selling in equities dominated headlines in January, the bond market, specifically the U.S. Treasury market, stepped into the spotlight in February. Optimism around more stimulus coupled with economic reopening supported higher inflation expectations, which put upward pressure on Treasury yields. The 10-year and 30-year rates both rose more than 0.3 percent during the month. Core U.S. bonds as represented by the Bloomberg Barclays Aggregate Index fell -1.4 percent (1). Higher yielding parts of the fixed income market benefitted from tightening credit spreads given the generally positive market tone.

Equity markets also rallied on more promising vaccine news with the S&P 500 Index returning 2.8 percent (2). International developed and emerging markets also generated positive absolute returns in February, but modestly below the U.S. market. Small cap and value stocks were standout performers across global equity markets. Those segments were hardest hit during the initial stages of the pandemic but have come back into favor as the prospects for those companies improve with more reopening measures and widescale vaccine distribution. U.S. small caps as represented by the Russell 2000 Index returned 6.2 percent in February1. Value companies within the international developed world (MSCI EAFE Value Index) returned 5 percent during the month (3).

Within real assets, higher inflation expectations continued to benefit the prices of most commodities, notably energy and industrial metals. The mid-February extreme cold weather in Texas caused some disruption in oil production, which further supported energy prices. A barrel of West Texas Intermediate (WTI) Crude Oil, the benchmark in the U.S., is now trading around $60.

Consumer Strength

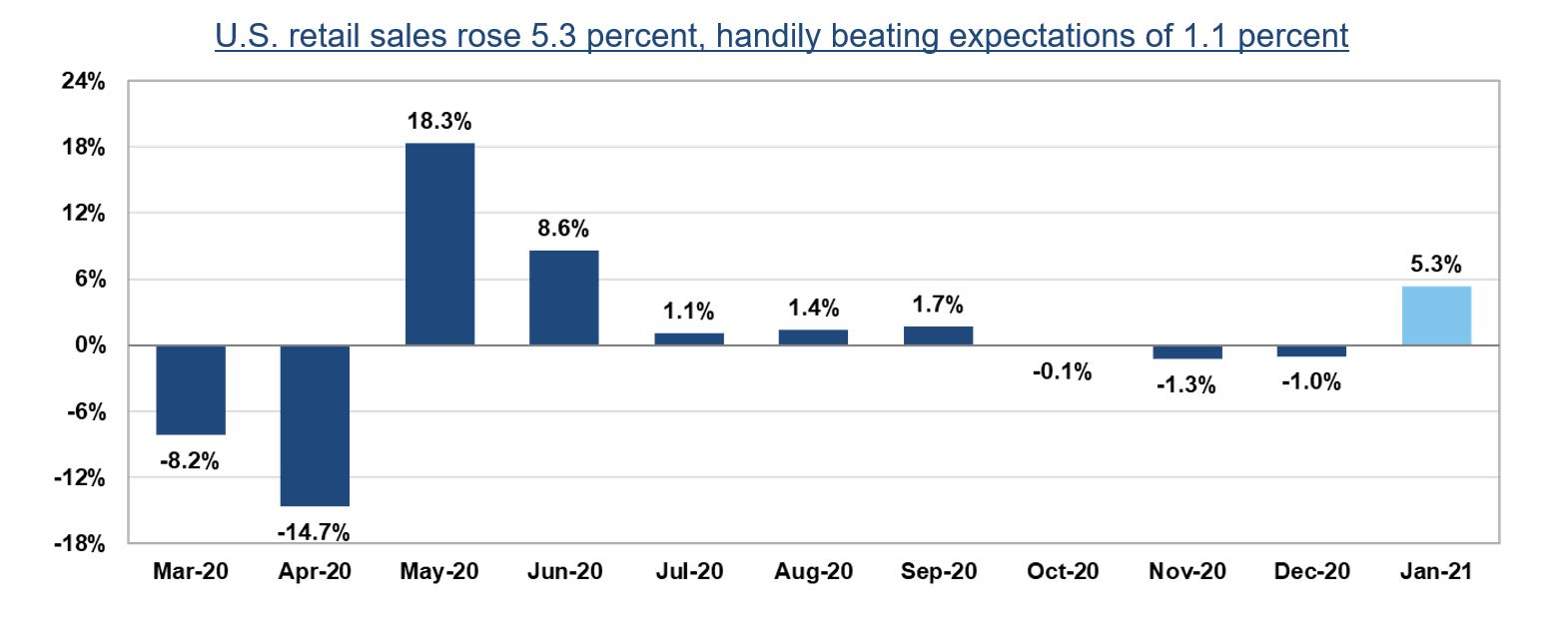

As we enter the spring and summer seasons and hopefully get back to some form of normalcy, investors will be keenly focused on consumer behavior and how fiscal stimulus and the easing of restrictions plays out in consumer goods spending data. Consumer spending accounts for more than two-thirds of U.S. GDP and thus will be a key component of the economic recovery. The latest retail sales report released in mid-February showed a 5.3 percent month-over-month jump in sales in January 2021. This far exceeded the forecast of 1.1 percent, perhaps indicating that stimulus checks are being spent and supporting the real economy.

Latest retail sales data came in much stronger than expected

The February retail sales data (5.3 percent month-over-month growth) might be an indication that consumers are ready and willing to spend. While growth in online sales has been a theme during the pandemic, the report showed healthy growth in other areas like restaurants and department stores. Stimulus checks sent in late 2020 likely had a positive impact, so it will be important to monitor future fiscal packages and the subsequent effect on consumer spending.

With more fiscal stimulus on the horizon and additional vaccination progress, the National Retail Federation, the world’s largest retail trading association, is forecasting potentially record-breaking 6.5 to 8.2 percent year-over-year retail sales growth in 2021. If that projection is accurate, it would likely accelerate the economic recovery.

Market Outlook

Risks certainly remain as we navigate a post-pandemic “new normal”. That said, we remain generally constructive on markets in the near-term. Consumer confidence and robust corporate earnings, among other data points, appear to be moving in the right direction and support our view. We will keep a close eye on these trends as well as policy measures, both monetary and fiscal, that are key to the success of the recovery.

For more information, please contact the professionals at Cedar Cove Wealth Partners.

Footnotes

- Bloomberg as of February 28, 2021.

- DiMeo Schneider & Associates, L.L.C.

- DiMeo Schneider & Associates, L.L.C.

The material presented includes information and opinions provided by a party not related to Thrivent Advisor Network. It has been obtained from sources deemed reliable; but no independent verification has been made, nor is its accuracy or completeness guaranteed. The opinions expressed may not necessarily represent those of Thrivent Advisor Network or its affiliates. They are provided solely for information purposes and are not to be construed as solicitations or offers to buy or sell any products, securities or services. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Thrivent Advisor Network and its affiliates accept no liability for loss or damage of any kind arising from the use of this information.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

THRIVENT IS THE MARKETING NAME FOR THRIVENT FINANCIAL FOR LUTHERANS. Certain insurance and annuity products issued by Thrivent. Not available in all states.

Investment advisory services offered through Thrivent Advisor Network, LLC., a registered investment adviser and a subsidiary of Thrivent. Clients will separately engage a broker-dealer or custodian to safeguard their investment advisory assets. Review the Thrivent Advisor Network ADV Disclosure Brochure and Wrap-Fee Program Brochure for a full description of services, fees and expenses. Thrivent Advisor Network LLC advisors may also be registered representatives of a broker-dealer to offer securities products.